Is Internal (Shadow) Carbon Pricing (ICP) the solution to Climate-related Financial Risks?

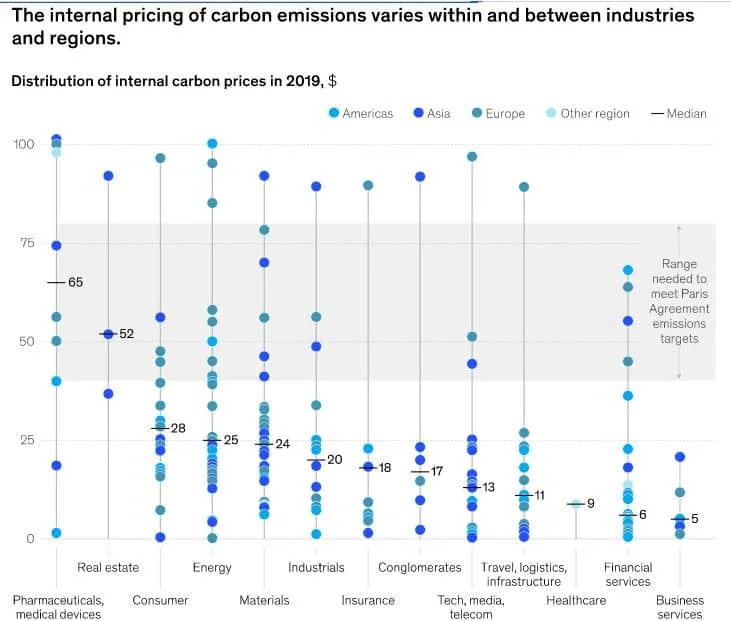

It has been estimated that a global carbon price of US$40 to US$80 per tCO2 in the 2020s, more than doubling to US$50 to US$100 per tCO2 by 2030, is required to meet the goals of the Paris Agreement.

Life got complicated, but not in a bad way. I just got busy, but it was worthwhile. I missed the newsletter and the feedback I receive from some of you is always so useful. I can’t thank you enough for the support. That being said, I have learnt something while I was away, and just couldn’t wait to share it with you.

Internal or Shadow Carbon Pricing (ICP) has gained traction in recent years as governments and businesses have become more focused on climate change mitigation. In 2023, over 400 large corporations have implemented ICP programs, and many more are considering doing so.

Source: https://carbonpricingdashboard.worldbank.org/

Internal or shadow carbon pricing (ICP) is a mechanism by which organisations can put a value on their greenhouse gas (GHG) emissions. This price is then used to inform decision-making, such as investments, projects, and procurement. For example, BP uses a price assumption of a US$100/teCO2 by 2030 to better understand the potential impact of future climate regulation on the profitability of a project, a new business model, or an investment. Smart move, considering a global carbon price of up to US$100/teCO2 by 2030 is the estimated to be what we need in order to meet the requirements of the Paris Agreement.

ICP can be used to value investments and projects in a number of ways. For example, a company might use ICP to:

Assess the financial risks of a project that could be affected by future carbon pricing regulations.

Compare the cost-effectiveness of different low-carbon investment options.

Prioritise investments that will reduce the company's carbon footprint.

To use ICP in valuations, organisations first need to set an internal carbon price. This can be done by considering a number of factors, including:

The current and future price of carbon in government-regulated markets.

The organisation's own emissions reduction targets.

The social cost of carbon, which is an estimate of the economic damages caused by each ton of carbon emissions.

Once an internal carbon price has been set, organisations can use it to factor in the cost of carbon when evaluating investments and projects. For example, a company might use ICP to calculate the net present value (NPV) of a project that would reduce the company's emissions. The NPV would take into account the cost of the project, the savings from reduced energy consumption, and the value of the carbon reductions.

Source: Internal Carbon Pricing Guide for Companies 2023 (CarbonCredits.com)

Microsoft is another great example of one of the many companies that are using ICP. In 2012 already, Microsoft had set an internal carbon price of $10 per ton of carbon. This price has been increased over time, and in 2023, Microsoft's internal carbon price is $50 per ton of carbon (the lower end of the required carbon price to meet the requirements of the Paris Agreement - I think they can do better).

Microsoft uses ICP to inform all of its major investment decisions. For example, when Microsoft is considering building a new data centre, it factors in the cost of carbon when evaluating different locations and design options.

Source: Official Microsoft Blog

Microsoft has also used ICP to reduce its carbon footprint significantly. In 2021, Microsoft achieved its goal of carbon neutrality. This means that Microsoft removes as much carbon from the atmosphere as it emits.

ICP is a powerful tool that can be used by organisations to reduce their carbon footprint, prepare for future carbon pricing regulations, and make more sustainable investment decisions. As more and more organisations adopt ICP, it is becoming an increasingly important part of the global effort to mitigate climate change.

While ICP is not new, the fact that has begun to gain more traction is a signal that large corporations are increasingly concerned about the climate-related risks that they are exposed to. A carbon price is a useful proxy for the extent of that exposure is today, and what it could be in the future as we transition into a low-carbon economy. We’re beginning to understand the impacts of climate change on financial performance, and the viability of the opportunities before us, a little bit better. We’re putting a number to it. That number is based on what it will take to meet the requirements of the Paris Agreement. Whether this is the solution to every challenge presented by the transition to a lower carbon economy for allocators of capital, only time will tell. It seems to be working for Microsoft though.

For more information:

https://www.carbonpricingleadership.org/

https://carbonpricingdashboard.worldbank.org/