ESG Integration in Business Valuation: Unlocking Value Beyond Financial Metrics

Aswath Damadoran is credited with the saying "valuations are both art and science". ESG integration in valuations is still more art than science, but we're making progress toward a more useful balance

In today's rapidly changing world, businesses face a growing imperative to integrate environmental, social, and governance (ESG) factors into their operations. Beyond the realm of corporate responsibility, ESG considerations have now emerged as critical components of the business valuation process. This week, we will explore the significance of ESG integration in business valuation, its impact on discount rates and cash flow forecasting, and shed light on the position of the International Valuation Standards Council (IVSC).

Traditionally, the valuation process focused primarily on financial metrics, often neglecting the long-term sustainability and resilience of a business. However, in recent years, stakeholders have recognised the importance of considering ESG factors in valuations. By integrating ESG criteria, businesses can gain a deeper understanding of their operational risks and opportunities, leading to more accurate and holistic valuations.

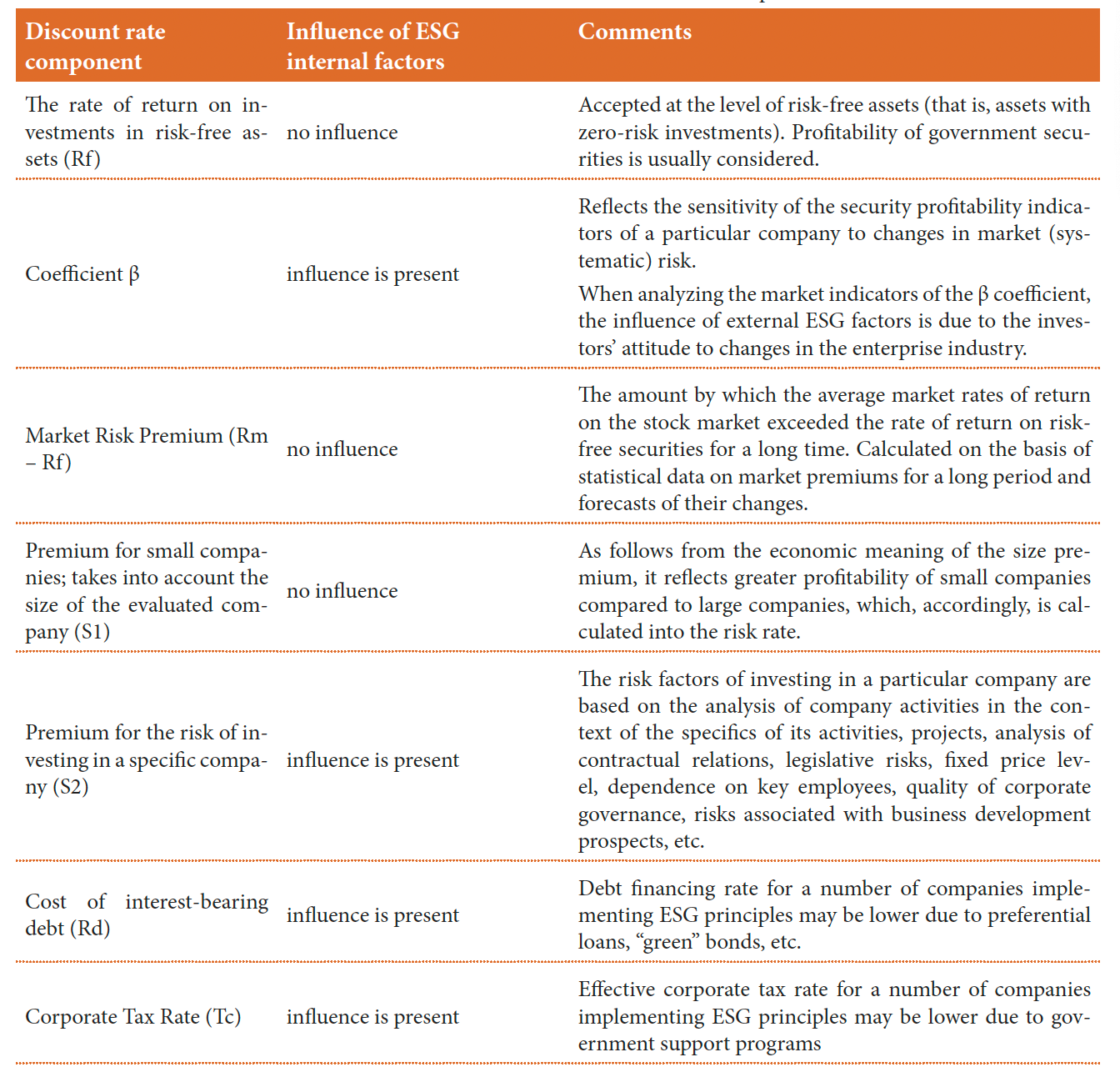

The discount rate is a crucial element in the valuation process, as it reflects the time value of money and the risk associated with future cash flows. ESG integration adds a new layer of complexity to determining the appropriate discount rate. Businesses that effectively manage ESG risks and demonstrate strong sustainability practices may warrant a lower discount rate, reflecting their reduced long-term risks and increased attractiveness to investors.

Conversely, companies with poor ESG performance may face higher discount rates, indicating a greater level of risk and uncertainty. Investors are increasingly recognising that ESG risks can have material financial impacts and are demanding that these risks be considered in the valuation process.

ESG integration also affects cash flow forecasting, a critical aspect of business valuation. ESG factors can influence a company's revenue streams, costs, and capital expenditures, altering the future cash flow projections. For example, investing in renewable energy sources may reduce operational costs in the long run, positively impacting cash flows. Similarly, reputational damage caused by ESG controversies can lead to revenue loss and increased costs.

Including ESG considerations in cash flow forecasting requires a comprehensive understanding of industry-specific ESG risks and opportunities. It also necessitates collaboration among financial analysts, sustainability experts, and other stakeholders to accurately capture the potential impacts of ESG factors on a company's financial performance.

Source: “Unlocking ESG Opportunities: Explore How ESG Impacts Business Value”, JLL (2022).

Research suggests that ESG factors can have material impacts on a company's financial performance, thereby influencing the income approach to valuation. Studies have examined the relationship between ESG performance and financial indicators such as revenue growth, profitability, and cost of capital. The findings indicate that companies with strong ESG practices tend to outperform their peers in terms of financial metrics, suggesting a positive correlation between ESG performance and valuation.

Source: “Accounting for ESG Risks in the Discount Rate for Business Valuation”, Zakhmatov, Vagizova & Valitov (2022).

The International Valuation Standards Council (IVSC) plays a crucial role in setting global standards for the valuation profession. Recognising the increasing importance of ESG integration, the IVSC has taken steps to address the topic. In its latest guidance, the IVSC emphasises the need for valuers to consider the impact of ESG factors on the valuation process and to use appropriate methodologies and data sources.

The IVSC's stance underscores the growing consensus that ESG integration is not merely a trend but a fundamental shift in the way businesses are valued. As ESG reporting frameworks and disclosure requirements evolve, it is crucial for valuers to stay informed and adapt their practices accordingly.

ESG integration in the business valuation process represents a paradigm shift, acknowledging the importance of sustainability and responsible corporate practices in determining a company's value. By considering ESG factors, valuers can provide a more accurate and comprehensive assessment of a business's risks, opportunities, and long-term value potential.

ESG integration impacts both the discount rate, reflecting the risk associated with future cash flows, and cash flow forecasting, which captures the financial implications of ESG factors. Additionally, the position of the IVSC highlights the significance of incorporating ESG considerations into the valuation profession.

As businesses navigate an increasingly complex and interconnected world, ESG integration in the valuation process becomes a key driver of sustainable growth and value creation. It allows businesses to align their financial objectives with their environmental and social responsibilities, ultimately unlocking value and resilience in the long term.

However, ESG integration in the valuation process is not without its challenges. One of the main hurdles is the lack of standardised data and metrics. ESG factors are diverse and industry-specific, making it difficult to compare and benchmark companies effectively. This issue has led to various ESG reporting frameworks and initiatives, aiming to provide standardised guidelines for businesses to disclose their ESG performance.

The IVSC recognises this challenge and encourages valuers to use reliable and relevant data sources when integrating ESG factors. In addition to data challenges, there may be skepticism among some valuers and investors regarding the financial materiality of ESG factors. Critics argue that incorporating non-financial metrics into the valuation process could lead to subjective assessments and potentially distort the true value of a business. However, growing evidence suggests that ESG factors do have financial implications, influencing market dynamics, customer preferences, and regulatory landscapes.

To mitigate these concerns, it is crucial to establish robust frameworks and methodologies for ESG integration. This includes defining clear valuation approaches, identifying relevant ESG indicators, and conducting thorough risk assessments. By adopting a systematic and transparent approach, valuers can address skepticism and enhance the credibility of ESG-integrated valuations.

Source: “Integration ESG Factors to Equity Valuation”, Inderpreet Singh, CFA (2022).

ESG integration in the business valuation process is a transformative shift that acknowledges the importance of sustainability and responsible practices. By going beyond financial metrics, businesses can capture the true value and long-term potential of their operations. The discount rate and cash flow forecasting are essential components that reflect the impact of ESG factors on a company's risk profile and financial performance.

The IVSC's position on ESG integration signals a recognition of the changing landscape and the need for consistent standards in the valuation profession. While challenges exist, such as data standardisation and skepticism, collaborative efforts and improved methodologies can help overcome these obstacles.

It's important to note that the field of ESG integration in business valuations is constantly evolving, and new research continues to emerge. Keeping up with the latest publications, industry standards, and evolving methodologies is crucial for professionals interested in incorporating ESG factors into the income approach to business valuations.

Remember, the integration of ESG factors in the valuation process is not just a trend but a fundamental shift towards a more holistic and inclusive approach to business assessment. Embrace it, and let your valuation reflect the true worth of your organisation in today's evolving landscape.