ESG-aligned investment opportunities in Africa.

Opportunities are manifold for ESG investors on the African continent.

There are several promising ESG investment opportunities in Africa. One area that has significant potential is renewable energy. Many African countries have abundant sources of renewable energy, such as solar, wind, and hydropower, and there is growing demand for clean energy as countries look to reduce their reliance on fossil fuels. Companies that are involved in the development and production of renewable energy sources in Africa can be attractive investments for those looking to align their portfolio with ESG principles. The continent’s vast renewable energy resources remain severely underutilized until today. Despite this potential, Africa has received only 2% of global renewable energy investments over the past two decades.

“Sustainable, renewable energy is fundamental to Africa's future. By 2050, the continent will be the home of 2 billion people, and two in five of the world’s children will be born there”. - World Economic Forum

Another area with potential for ESG investment in Africa is sustainable agriculture. The continent has a large and growing population, and demand for food is expected to increase significantly in the coming years. Companies that are working to increase crop yields and improve food security through sustainable farming practices can be a good fit for ESG investors.

“Untapped business opportunities abound in Africa's agriculture sector. Beyond the profits, however, investing in African agriculture offers the rare chance to catalyze growth in a sector that employs more than half of all working people in Sub-Saharan Africa and to move the continent towards food sovereignty”. - Empower Africa

There are also opportunities for ESG investment in the healthcare sector in Africa. Many African countries have a shortage of healthcare facilities and trained professionals, and there is a need for investments to improve healthcare infrastructure and access to care.

Over the next decade, the International Finance Corporation (IFC) estimates that between $25-$30 Billion in new investments will be needed to meet Africa’s healthcare demand.

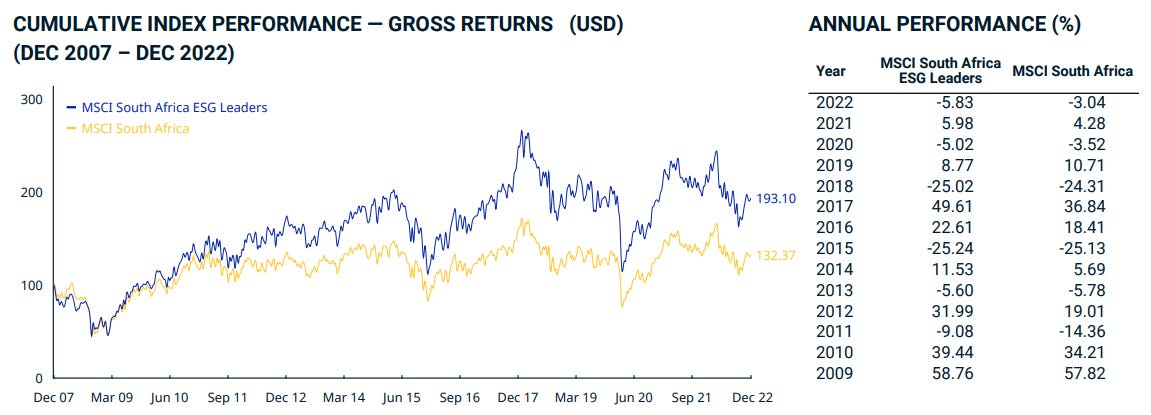

In addition to these specific sectors, there are also opportunities for ESG investment in Africa through funds and indexes that focus on companies with strong ESG practices across a range of industries. These funds and indexes can provide diversification and allow investors to access a broad range of ESG investment opportunities in Africa.

Source: https://www.msci.com

It is important to note that investing in Africa carries additional risks compared to investing in developed markets, such as political instability, currency risk, and infrastructure challenges. However, with careful due diligence and a long-term perspective, ESG investing in Africa can offer the potential for both financial returns and positive social and environmental impact.